|

|

rpforpres rpforpres |

| November 13, 2012, 8:09am |

|

Hero Member  Posts

3,891

Reputation

89.47%

Reputation Score

+17 / -2

Time Online

113 days 4 hours 29 minutes

|

|

|

|

|

|

|

mikechristine1 mikechristine1 |

| November 13, 2012, 8:19am |

|

Hero Member  Posts

9,074

Reputation

71.88%

Reputation Score

+23 / -9

Time Online

99 days 18 hours 36 minutes

|

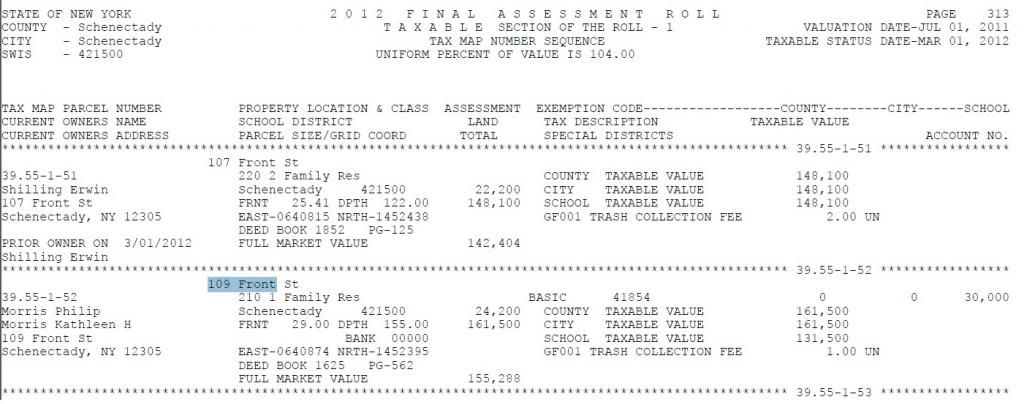

Yes, a paper trail So Morris was LATE paying taxes!!!!!!!! And again, WHY WHY WHY WHY WHY does he still have a STAR exemption! He does NOT live there. STAR is ONLY for owners who reside IN the house!!!!!!!!! By law, a property owner cannot have two STAR exemptions!!!!!!! Get this out to all the local TV news! |

| Optimists close their eyes and pretend problems are non existent.

Better to have open eyes, see the truths, acknowledge the negatives, and

speak up for the people rather than the politicos and their rich cronies. |

|

Logged Logged |

|

|

|

|

rpforpres rpforpres |

| November 13, 2012, 8:22am |

|

Hero Member  Posts

3,891

Reputation

89.47%

Reputation Score

+17 / -2

Time Online

113 days 4 hours 29 minutes

|

MikeChristine I called the Sch'dy assessors and the guy said there was no exemption on the front st property, found the school tax bill and whalla sp?

|

|

|

|

|

|

mikechristine1 mikechristine1 |

| November 13, 2012, 9:20am |

|

Hero Member  Posts

9,074

Reputation

71.88%

Reputation Score

+23 / -9

Time Online

99 days 18 hours 36 minutes

|

MikeChristine I called the Sch'dy assessors and the guy said there was no exemption on the front st property, found the school tax bill and whalla sp?

Yes, and the OFFICIAL FINAL Tax roll for the city has a STAR exemption! Of course, they are all trying to hide the truth! I will bet there is a note in their computers that says "don't admit to this STAR exemption." Page 313 of the FINAL city tax roll for 2012. This is the tax roll used for the school tax bills for the school year 2012-2013. Morris has NOT live in that property since 2010!!!!!! And to clarify, the "taxable status date" which is March 1, 2012, the STAR exemption would be based on ownership AND PRIMARY RESIDENCE/OCCUPANCY as of that date! For example, a homeowner who bought a house and the closing was held on March 2, 2012, would NOT be eligible for STAR for 2012-2013, they would have to wait until March 1, 2013. Time to call ALL the news media. Actually, call the state, which ever department is doing the audit  |

| Optimists close their eyes and pretend problems are non existent.

Better to have open eyes, see the truths, acknowledge the negatives, and

speak up for the people rather than the politicos and their rich cronies. |

|

Logged Logged |

|

|

|

|

rpforpres rpforpres |

| November 13, 2012, 9:52am |

|

Hero Member  Posts

3,891

Reputation

89.47%

Reputation Score

+17 / -2

Time Online

113 days 4 hours 29 minutes

|

Question: An individual claims primary residency in two properties. Should the STAR penalties be imposed on both properties even if one of the properties does, in fact, serve as the applicant's primary residence?

Answer: There is no material misstatement on the application for the individual's primary residence, so the $100 penalty tax doesn't apply thereto. However, assuming that there was a material misstatement on the other application, the applicant would be "disqualified from further exemption pursuant to this section [RPTL, 425] for a period of five years," so the property would not be eligible for STAR on either residence for a period of five years. However, this penalty does not apply if the exemption has been renounced by the individual on one of the two properties (RPTL 496).

|

|

|

|

|

|

mikechristine1 mikechristine1 |

| November 13, 2012, 10:03am |

|

Hero Member  Posts

9,074

Reputation

71.88%

Reputation Score

+23 / -9

Time Online

99 days 18 hours 36 minutes

|

Question: An individual claims primary residency in two properties. Should the STAR penalties be imposed on both properties even if one of the properties does, in fact, serve as the applicant's primary residence?

Answer: There is no material misstatement on the application for the individual's primary residence, so the $100 penalty tax doesn't apply thereto. However, assuming that there was a material misstatement on the other application, the applicant would be "disqualified from further exemption pursuant to this section [RPTL, 425] for a period of five years," so the property would not be eligible for STAR on either residence for a period of five years. However, this penalty does not apply if the exemption has been renounced by the individual on one of the two properties (RPTL 496).

PENALIZE MORRIS! He knows DAMN WELL that he has the STAR exemption on BOTH properties. Like ALL homeowners, he DOES get the tax bill, and if his tax is escrowed, then he DOES get a copy of the tax bill showing the date paid. Tax bills CLEARLY indicate exemptions and exemption amounts! Morris has chosen NOT to renounce his STAR exemption, so he MUST be penalized. Oh, then the county will increase the line item in the budget to pay him more. Or instead of him forcing volunteers to pay $75 to volunteer, he'll increase that to $100 a year! |

| Optimists close their eyes and pretend problems are non existent.

Better to have open eyes, see the truths, acknowledge the negatives, and

speak up for the people rather than the politicos and their rich cronies. |

|

Logged Logged |

|

|

|

|

|

bumblethru bumblethru |

| November 13, 2012, 10:24am |

|

Hero Member  Posts

30,841

Reputation

78.26%

Reputation Score

+36 / -10

Time Online

412 days 18 hours 59 minutes

|

print....scan....email to Vandenburg and Greg Floyd and the TU's lauren. |

| When the INSANE are running the ASYLUM

In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule. -- Friedrich Nietzsche “How fortunate for those in power that people never think.”

Adolph Hitler |

|

Logged Logged |

|

|

|

|

rpforpres rpforpres |

| November 27, 2012, 9:53pm |

|

Hero Member  Posts

3,891

Reputation

89.47%

Reputation Score

+17 / -2

Time Online

113 days 4 hours 29 minutes

|

Was posting an item on craigslist and scroled though the free items for the heck of it, hey you never know. Anyways came across something that should interest all, you'll understand when you see the address, a renter ???!!!!!!

CURB ALERT!!! (Schenectady's Stockade)

--------------------------------------------------------------------------------

Date: 2012-11-26, 1:14PM EST

Reply to this post bzznt-3435806066@sale.craigslist.org[Errors when replying to ads?]

--------------------------------------------------------------------------------

Three large boxes of homeschool books (secular & non-secular)

Area Rug

Yoga mat

Children's tool bench and miscellaneous tools

Various other things

Still moving (until 4p), so more will be added as the day goes on!!!

109 Front Street, Schenectady NY 12305

• Location: Schenectady's Stockade

•it's NOT ok to contact this poster with services or other commercial interests

PostingID:3435806066 |

|

|

|

|

|

mikechristine1 mikechristine1 |

| November 27, 2012, 10:20pm |

|

Hero Member  Posts

9,074

Reputation

71.88%

Reputation Score

+23 / -9

Time Online

99 days 18 hours 36 minutes

|

Very interesting. Wonder if it's a tenant or whether our persistence is making him lose his ILLEGAL STAR exemption so he's going to sell. We will have to watch. OF COURSE, DV claims he wants to live in the stockade, maybe he'll buy it. No, don't think so, unemployed grown men who are not living like normal adults would not get approved for a mortgage

|

| Optimists close their eyes and pretend problems are non existent.

Better to have open eyes, see the truths, acknowledge the negatives, and

speak up for the people rather than the politicos and their rich cronies. |

|

Logged Logged |

|

|

|

|

rpforpres rpforpres |

| November 28, 2012, 9:57am |

|

Hero Member  Posts

3,891

Reputation

89.47%

Reputation Score

+17 / -2

Time Online

113 days 4 hours 29 minutes

|

|

|

|

|

|

Madam X Madam X |

| November 28, 2012, 11:12am |

|

Hero Member  Posts

3,190

Reputation

66.67%

Reputation Score

+8 / -4

Time Online

26 days 9 hours 21 minutes

|

Isn't the city bound by some sort of law to keep records up to date? Or is that another duty they just gave up on under the false excuse of "no money"? |

|

|

|

|

|

|